fulton county ga sales tax rate 2019

The 1 MOST does not apply to sales of motor vehicles. And pursuant to the requirements of OCGA.

Construction Contractors Georgia Sales And Use Tax Obligations Litwin Law

30301 30302 30303.

. Rate Changes Effective July 1 2020 - UPDATED 12Jun2020 5752 KB Rate Changes Effective July 1 2020 5842 KB Rate Changes Effective April 1 2020 5395 KB Rate Changes Effective January 1 2020 5215 KB Rate Changes Effective October 1 2019 5374 KB Rate Changes Effective July 1 2019 558 KB. The Fulton County Sales Tax is 26 A county-wide sales tax rate of 26 is applicable to localities in Fulton County in addition to the 4 Georgia sales tax. The December 2020 total local sales tax rate was also 8900.

837 Average Sales Tax Summary Fulton County is located in Georgia and contains around 7 cities towns and other locations. The Fulton County sales tax rate is. Helpful Links Cities of Fulton County.

Fulton County GA Sales Tax Rate The current total local sales tax rate in Fulton County GA is 7750. The base rate of Fulton County sales tax is 375 so when combined with the Georgia sales tax rate it totals 775. The December 2020 total local sales tax rate was also 7750.

Some cities and local governments in Fulton County collect additional local sales taxes which can be as high as 19. Fultons rate inside Atlanta is 3. The Board of Commissioners and County Manager have categorized County efforts into six strategic areas.

The current total local sales tax rate in Atlanta GA is 8900. Tax Commissioner 404-613-6100 Tax Commissioner Homepage 141 Pryor Street SW Atlanta GA 30303 Tax Commissioner Fulton County Tax Commissioner Dr. 48-5-32 does hereby publish the following.

The December 2020 total local sales tax rate was also 7750. The Atlanta Georgia sales tax is 890 consisting of 400 Georgia state sales tax and 490 Atlanta local sales taxesThe local sales tax consists of a 300 county sales tax a 150 city sales tax and a 040 special district sales tax used to fund transportation districts local attractions etc. Except when the first Tuesday of the month falls on a legal holiday in which case the sale is held the next business day.

The most populous location in Fulton County Georgia is Atlanta. The 2018 United States Supreme Court decision in South Dakota v. The Fulton County Georgia sales tax is 775 consisting of 400 Georgia state sales tax and 375 Fulton County local sales taxesThe local sales tax consists of a 300 county sales tax and a 075 special district sales tax used to fund transportation districts local attractions etc.

Fairburn GA Sales Tax Rate The current total local sales tax rate in Fairburn GA is 7750. Ferdinand is elected by the voters of Fulton County. The Fulton County Tax Commissioner is responsible for collecting property taxes on behalf of Fulton County Government two school systems and some city governments.

Fulton County Sheriffs Tax Sales are held on the first Tuesday of each month between the hours of 10 am. As for zip codes there are around 75 of them. There are a total of 477 local tax jurisdictions across the state collecting an average local tax of 3683.

Click here to see the August 2022 Tax List. How Does Sales Tax in Fulton County compare to the rest of Georgia. Fulton County in Georgia has a tax rate of 775 for 2022 this includes the Georgia Sales Tax Rate of 4 and Local Sales Tax Rates in Fulton County totaling 375.

Georgia has recent rate changes Thu Jul 01 2021. 7683 Georgia has state sales tax of 4 and allows local governments to collect a local option sales tax of up to 4. Click here for a larger sales tax map or here for a sales tax table.

Sales Tax Breakdown Fairburn Details Fairburn GA is in Fulton County. Interactive Tax Map Unlimited Use. This is the total of state and county sales tax rates.

Atlanta is in the following zip codes. Inside the City of Atlanta in both DeKalb County and Fulton County the tax rate for motor vehicle sales is 1 less than the generally applicable tax rate. Ad Lookup Sales Tax Rates For Free.

Has impacted many state nexus laws and. In Clayton County the tax rate for motor vehicle sales is 1 less than the generally applicable tax rate. The average cumulative sales tax rate between all of them is 837.

A full list of these can be found below. Sales Tax Breakdown Atlanta Details Atlanta GA is in Fulton County. Georgia GA Sales Tax Rates by City The state sales tax rate in Georgia is 4000.

The total 775 Fulton County sales tax rate is only applicable to businesses and sellers that are not in the Greater Atlanta area. The Georgia state sales tax rate is currently. Surplus Real Estate for Sale.

4 Average Sales Tax With Local. With local taxes the total sales tax rate is between 4000 and 8900. Fairburn is in the following zip codes.

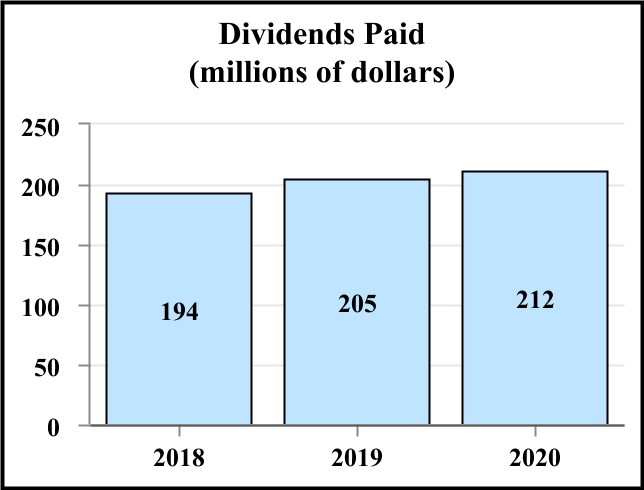

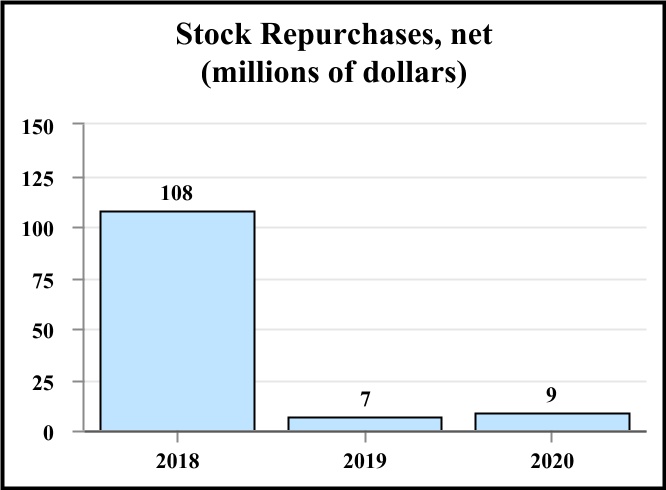

Atlanta GA 30303 404-612-4000 customerservicefultoncountygagov. The 85 sales tax rate in Atlanta consists of 4 Georgia state sales tax 26 Fulton County sales tax 15 Atlanta tax and 04 Special taxThe sales tax jurisdiction name is Atlanta Tsplost Tl which may refer to a local government divisionYou can print a 85 sales tax table hereFor tax rates in other cities see Georgia sales taxes by city and county. FULTON COUNTY GEORGIA July 2019 FINANCIAL RESULTS Unaudited Cash Basis.

Select the Georgia city from the list of popular cities below to see its current sales tax rate. You can find more tax rates and allowances for Fulton County and Georgia in the 2022 Georgia Tax Tables. The Fulton County Board of Commissioners does hereby announce that the 2021 General Fund millage rate will be set at a meeting to be held at the Fulton County Assembly Hall located at 141 Pryor Street Atlanta GA 30303 on August 18 2021 at 10 am.

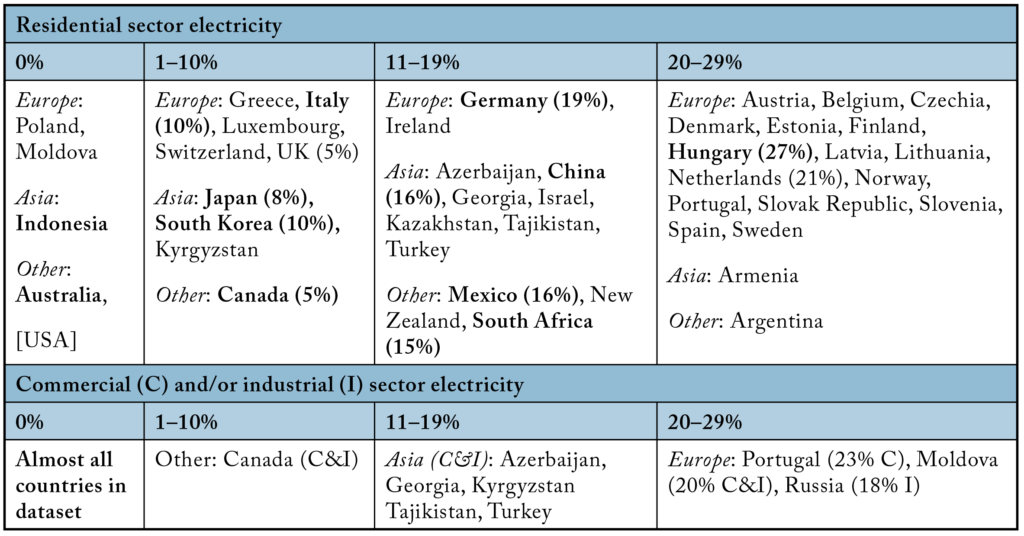

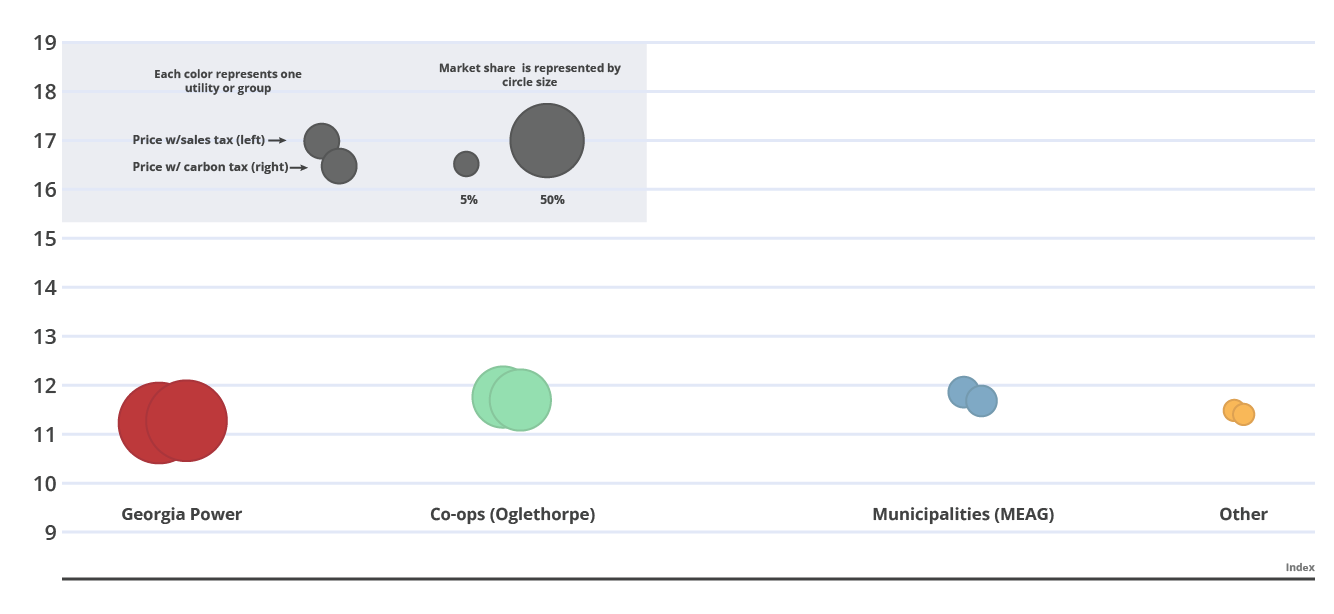

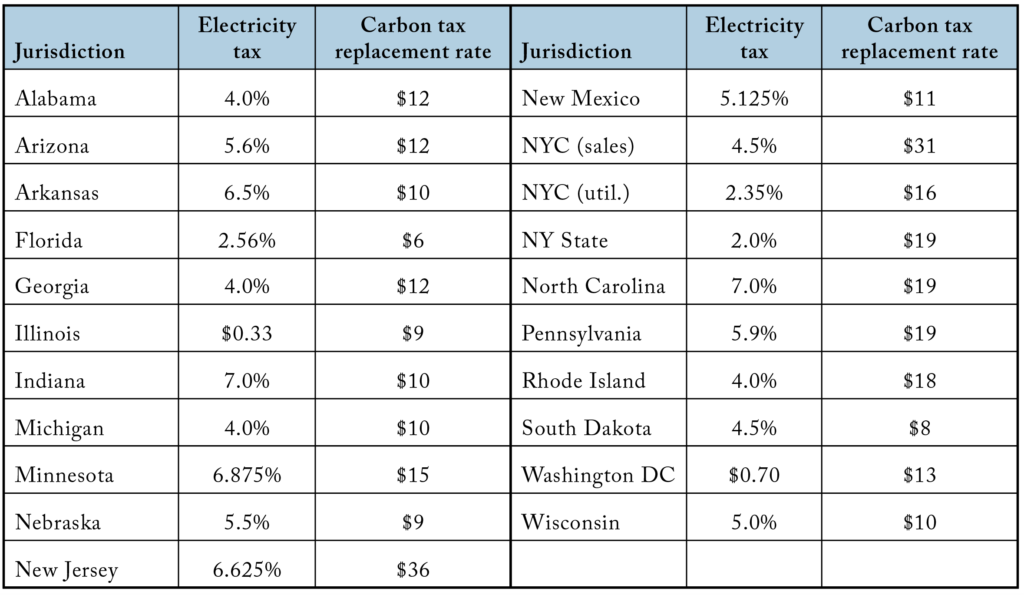

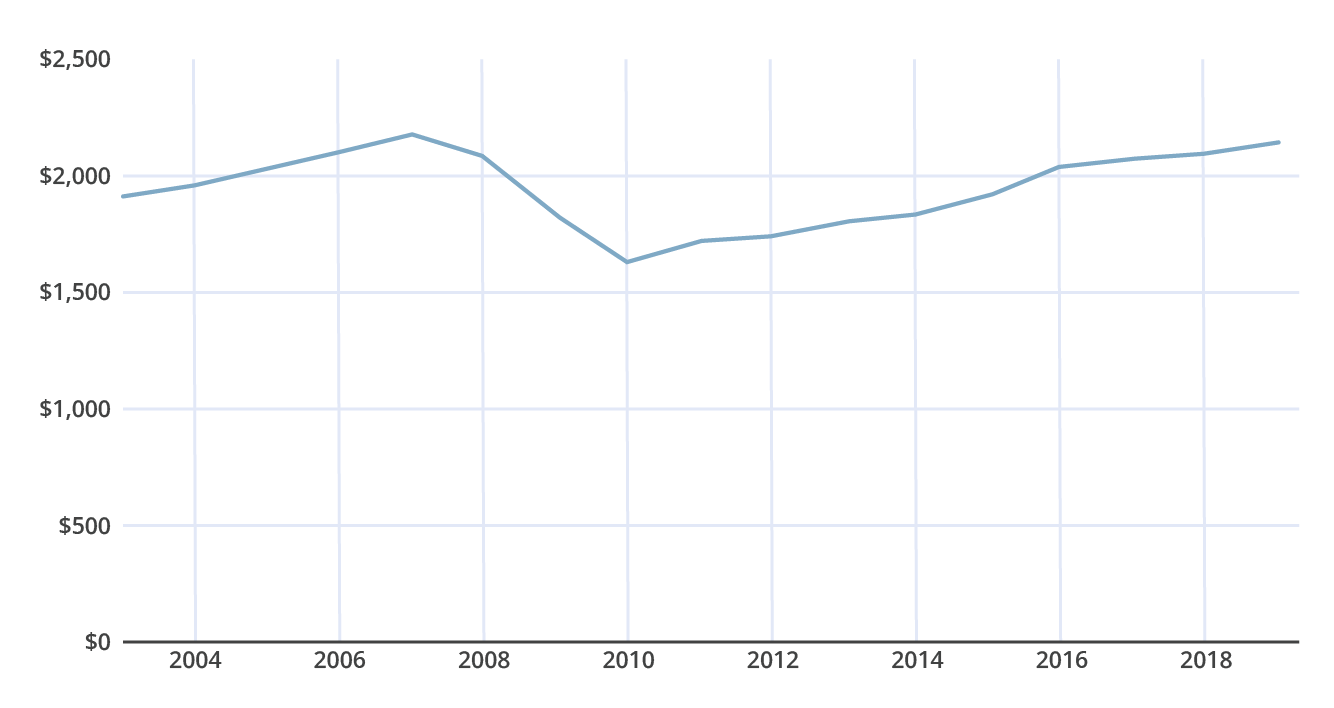

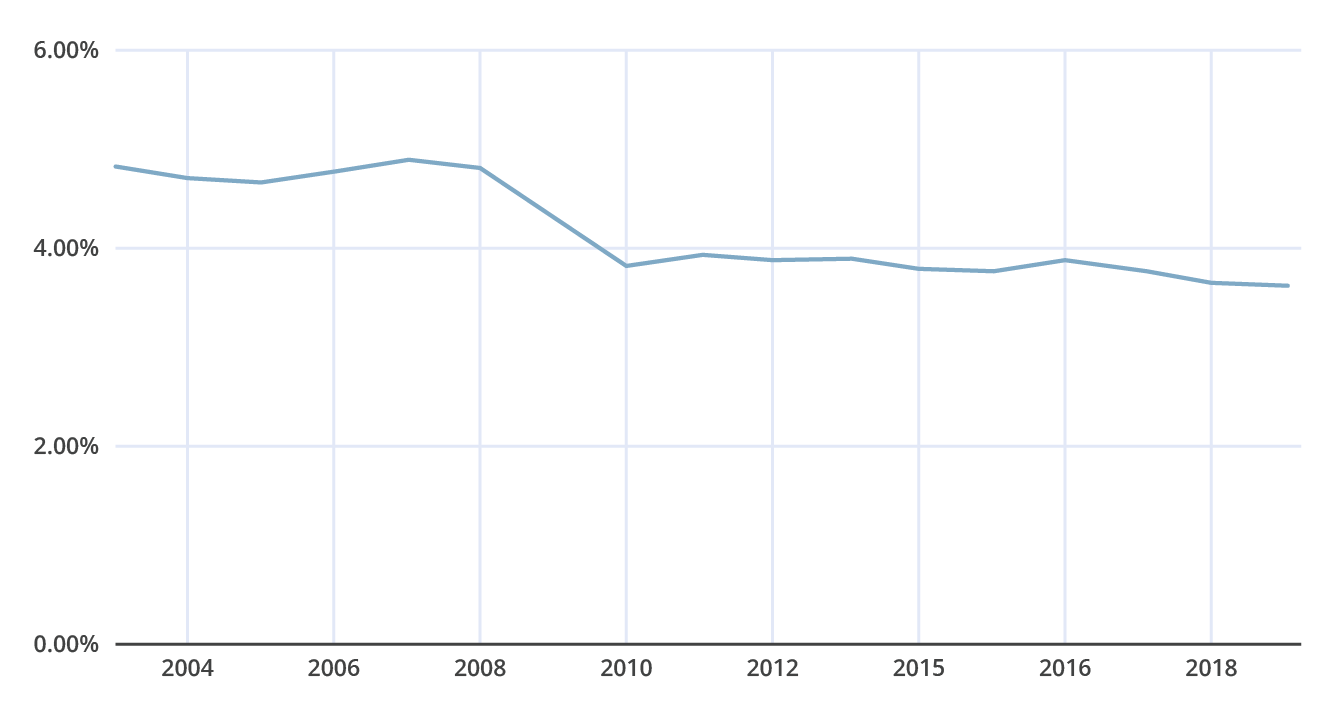

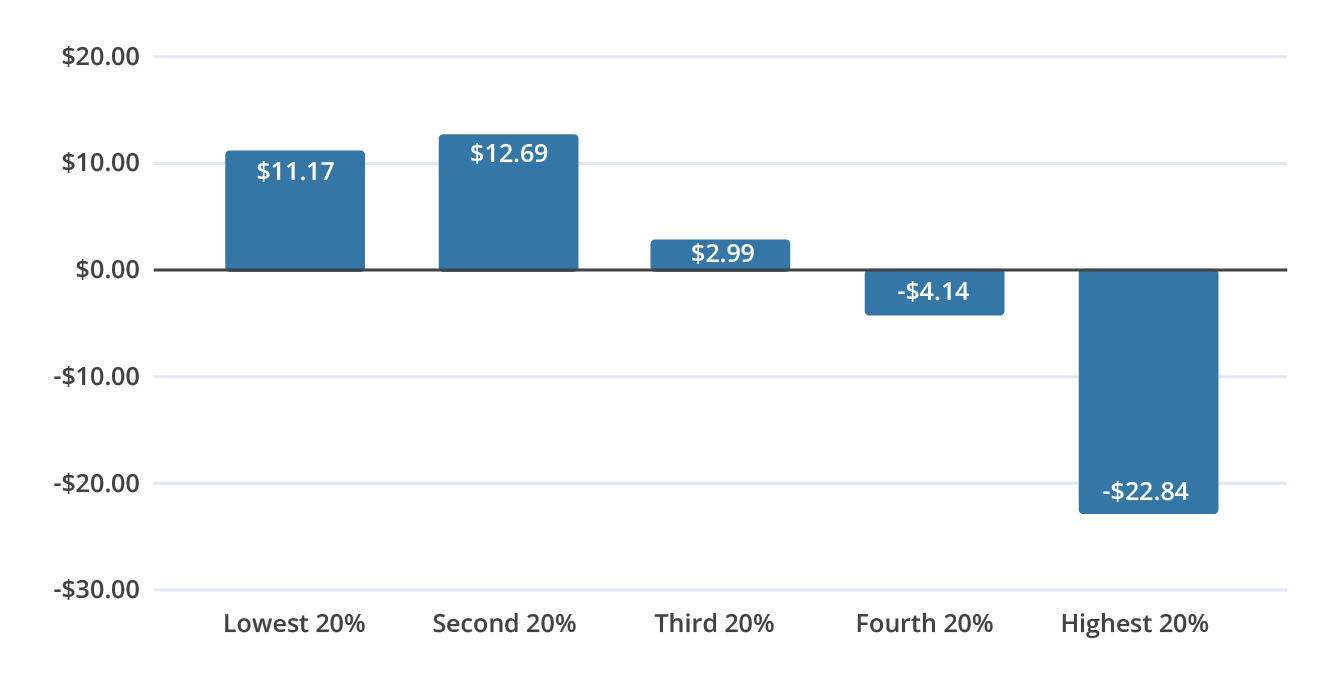

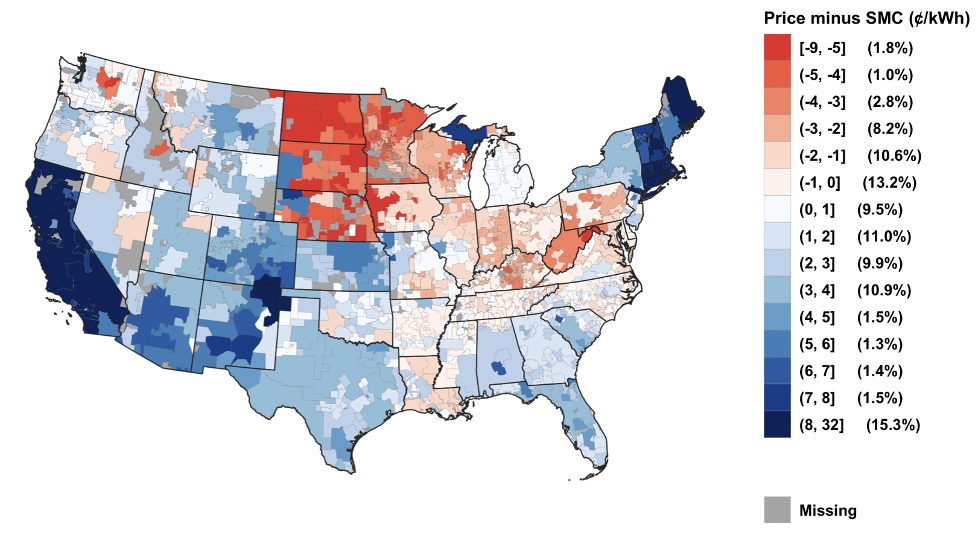

Carbon Taxes Without Tears The Cgo

California Sales Tax Rates By City

Carbon Taxes Without Tears The Cgo

Carbon Taxes Without Tears The Cgo

Carbon Taxes Without Tears The Cgo

Carbon Taxes Without Tears The Cgo

Carbon Taxes Without Tears The Cgo