tax loss harvesting limit

Whenever total capital gains and losses for the year add up to a negative number a net capital loss is incurred. Tax loss harvesting cannot turn a loss into a gain but it can mitigate your losses by reducing your tax liability.

Calculating The True Benefits Of Tax Loss Harvesting Tlh

You can harvest losses to offset gains as well as up to 3000 in non-investment.

. Chief among them is that tax-loss harvesting does not eliminate taxes on capital gains but only defers them to a later time. Limitations to Tax-Loss Harvesting There are certain limitations to the effectiveness of this strategy in addition to regulations put in place by the Internal Revenue. For instance if an investment was originally purchased for 20000 but is now down to 14000 a big 30 decline then harvesting the loss generates a 6000 capital loss.

If the investor harvested losses by selling mutual funds B and C they would help to offset the gains and the tax liability would be. Tax-loss harvesting can offer tax benefits but there are limitations on what you can deduct. Say I buy a Share1 at EUR 1000 and sell it in the same year.

The leftover 2000 loss could then be carried forward to offset income in future tax years. As a married couple filing jointly. Even if you cant claim the maximum 3000 net loss you can still reduce the value of your gains and save on taxes that way.

Taxes may not be due until april 15 but now is the time to decide whether you should do any tax loss harvesting to limit the recognition of. Ad Make Tax-Smart Investing Part of Your Tax Planning. To tax-loss harvest Mary would sell that fund thereby recognizing a 7000 capital loss.

The losses can offset. Ad Make Tax-Smart Investing Part of Your Tax Planning. Tax-loss harvesting is when you sell investments at a loss in order to reduce your tax liability.

Connect With a Fidelity Advisor Today. What is tax-loss harvesting. Tax-loss harvesting the act of selling a security in a taxable account at a loss and using the loss to offset realized taxable gains to help reduce taxes can be a silver lining.

And Mary would use the proceeds from the sale to purchase another fund to serve as a. There is no limit to the amount of investment gains that can be offset with tax-loss harvesting. Currently the amount of excess losses you can claim as a deduction is the lesser.

So if you have a 4000 gain and a 1000 loss youd. 2 ways tax-loss harvesting can help manage taxes. Through a strategy called tax-loss harvesting investments that are in the red can be your ticket to a lower tax bill up to 3000 a year.

Market conditions may limit the ability to generate tax losses. Since I am the beginner I would appreciate if you could help me clarifying tax-loss harvesting in more details. If you sell shares at a 7000 loss and use those.

Assuming youre subject to a 35 marginal tax rate the overall tax benefit of. Tax with harvesting 200000 - 130000 x. Tax-loss harvesting involves the risks that the new investment could perform worse than the original investment.

The losses can be used to offset investment gains. However there are limits to the amount of taxes on ordinary income that can be. If the net capital loss is less.

Connect With a Fidelity Advisor Today. An investment loss can be used for 2 different things. Is there a limit to tax-loss harvesting.

Limit capital gains for your clients Help your clients offset short-and long-term capital gains with automatic tax-loss harvesting of client accounts. Even better any remaining tax losses can be used to reduce your.

.jpg)

The Beginner S Guide To Cryptocurrency Tax Loss Harvesting Cryptotrader Tax

Tax Loss Harvesting Definition Example How It Works

.jpg)

The Beginner S Guide To Cryptocurrency Tax Loss Harvesting Cryptotrader Tax

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Turning Losses Into Tax Advantages

Turning Losses Into Tax Advantages

.jpg)

The Beginner S Guide To Cryptocurrency Tax Loss Harvesting Cryptotrader Tax

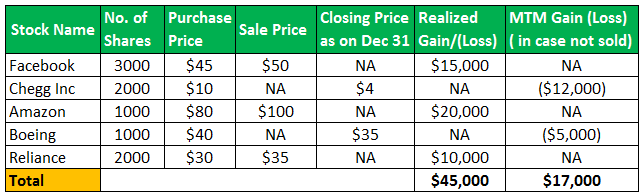

Tax Loss Harvesting Example Of Tax Loss Harvesting How Does It Work

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

Reap The Benefits Of Tax Loss Harvesting

Calculating The True Benefits Of Tax Loss Harvesting Tlh

How To Use Tax Loss Harvesting To Lower Your Taxes Ally

Tax Loss Harvesting Definition Example How It Works

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Tax Loss Harvesting Everything You Should Know

Crypto Tax Loss Harvesting Investor S Guide Koinly